Personal debt to equity ratio calculator

Credit score requirements can also vary by. Equity is the difference between what you owe on the house and its market value.

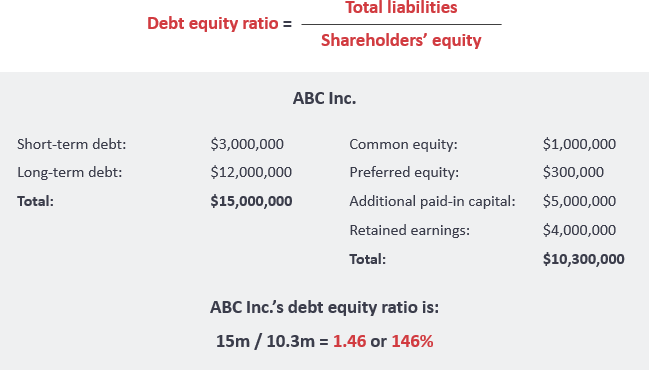

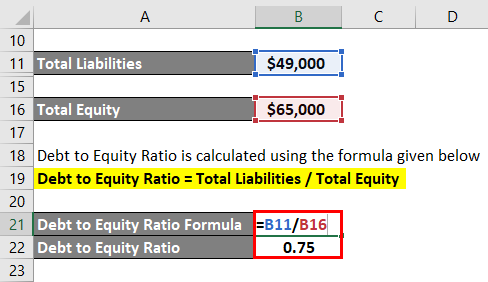

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Simply complete the fields in the form below and click Calculate button.

. The 14 billion Chicago-based credit union founded in 1935 is one of the. Instead lenders apply a formula to the maximum size of a HELOC expressed as the combined loan-to-value CLTV ratio. Lenders typically prefer your DTI to be less than 43 though some will allow.

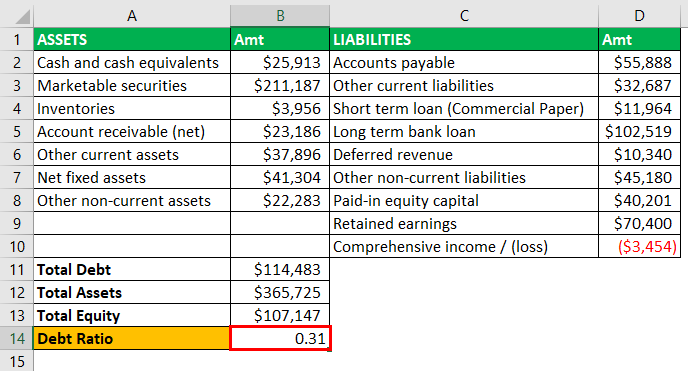

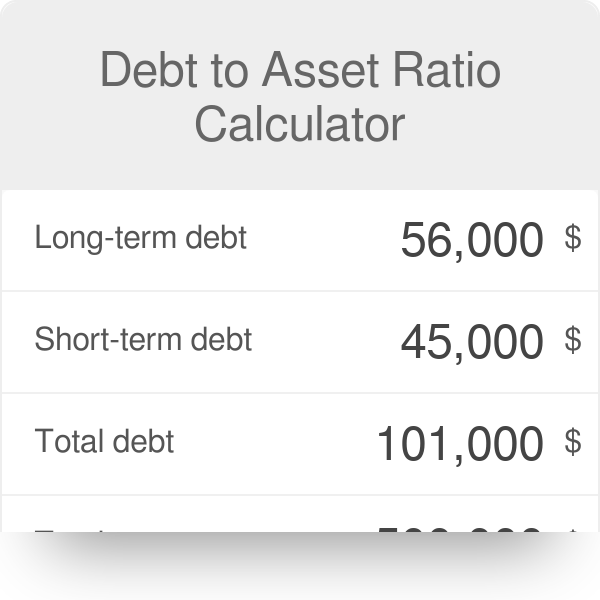

So as you pay off your personal loan for debt. Get all the latest India news ipo bse business news commodity only on Moneycontrol. The debt-to-asset ratio shows the percentage of total assets that were paid for with borrowed money represented by debt on the business firms balance sheet.

On Wednesday September 07 2022 the current average 30-year fixed-mortgage rate is 602 increasing 8 basis points over the last week. Personal loan rates currently range from 573. Personal loan is the most commonly availed loan product in the Indian debt industry.

A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. The APR on a personal loan for debt consolidation should be lower than that of your prior individual debts and that rate will be fixednot variable. Lenders will check your credit score income debt-to-income DTI ratio and maximum loan-to-value LTV ratio.

What is the debt-to-income ratio to qualify for a home equity loan. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Use this calculator to compute your personal debt-to-income ratio a figure as important as your credit score which provides a snapshot of your overall financial health.

So for example if the market price of your property is 850000 and your outstanding loan balance is 500000 you have up to 350000 of equity. Get 247 customer support help when you place a homework help service order with us. A personal loan that combines multiple debts into one monthly.

Our DSCR calculator enables you to calculate your companys debt service coverage ratio DSCR with ease. For commercial lenders the debt service coverage ratio or DSCR is the single-most significant element to take into consideration when analyzing the level of risk. You can also roughly work out your equity using this calculator.

This ratio measures how much debt a business has compared to its equity. If you need money fast Alliant Credit Union typically makes same-day online personal loans between 1000 and 50000. The debt-to-equity ratio is one of the most commonly used leverage ratios.

That includes debts such as credit cards auto loans mortgages home equity. A debt-to-income ratio is the percentage of gross monthly income that goes toward paying debts and is used by lenders to measure your ability to manage monthly payments and repay the money borrowed. What is a debt-to-income ratio.

This ratio helps your lender understand your financial capacity to pay your mortgage each month. Home equity loans usually. Todays national mortgage rate trends.

There are two kinds of DTI ratios front-end and back-end which are typically shown as a percentage like 3643. Second mortgage types Lump sum. If youre a homeowner with strong credit and financial discipline tapping your home equity could be a good debt consolidation option for you.

In the previous example the company with the 50 debt to equity ratio is less risky than the firm with the 125 debt to equity ratio since debt is a riskier form of financing than equity. The lender checks your credit and debt-to-income ratio. The unsecured nature of these loans makes them a popular choice among prospective borrowers.

Debt to Equity Ratio Formula Example. Along with being a part of the financial leverage ratios the debt to equity ratio is also a part of the group of ratios called gearing ratios. This is also known as usable equity as it.

In addition to loan-to-value and combined loan-to-value ratios lenders will consider your DTI when you apply for a home equity loan or line of credit. Your debt-to-income ratio DTI indicates the percentage of your monthly income that is committed to paying off debt. The rule states that you should aim to for a debt-to-income DTI ratio of roughly 36 or less or 43 maximum for a FHA loan when applying for a mortgage loan.

Let Bankrate a leader. DTI ratio affects how much of your home equity you can access. The higher the ratio the less likely it is that you can afford the mortgage.

It is an indicator of financial leverage or a measure of. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. If you make a down payment of less than 25 you typically need a credit score of at least 680 and low debts or 720 with a higher debt-to-income ratio.

Debt to Equity Ratio - What is it. In other words if you pay 2000 each month in debt services and you make 4000 each month your ratio is 50half of your monthly income is used to pay the debt. Rarely can you borrow against all the equity in your home.

A companys debt-to-asset ratio is one of the groups of debt or leverage ratios that is included in financial ratio analysis. Over 78 of all credits availed in India fall under this category. Home equity loans have more stringent requirements than mortgages.

Second mortgages come in two main forms home equity loans and home equity lines of credit. Personal Loan EMI Calculator Calculate Your Personal Loan EMI Online. You provide a heck of a lot of documentation about your debt finances identity mortgage insurances and more.

The best debt consolidation loans cover the total amount of all of your combined debt so that you can pay off your different debts upfront leaving you with one simple monthly payment. Bankrates experts compare hundreds of top credit cards and credit card offers to select the best in cash back rewards travel business 0 APR balance transfer and more. Tap your home equity.

That is your homes value minus its outstanding mortgage balance. A home equity line of credit HELOC is a loan secured by the equity in your house. A personal loan can be a better option if you can secure a lower interest rate or dont want to risk losing your home with a home equity loan.

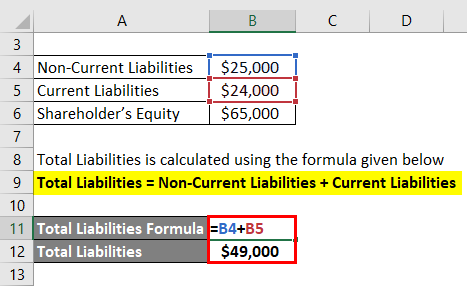

The debt-to-equity ratio is calculated by dividing total liabilities by shareholders equity or capital.

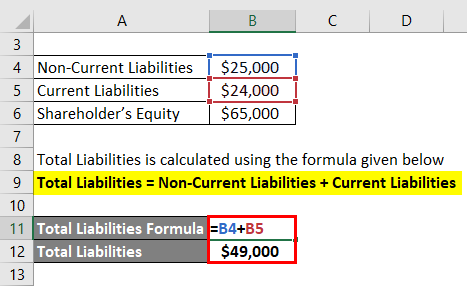

Debt To Equity Ratio Calculator Formula

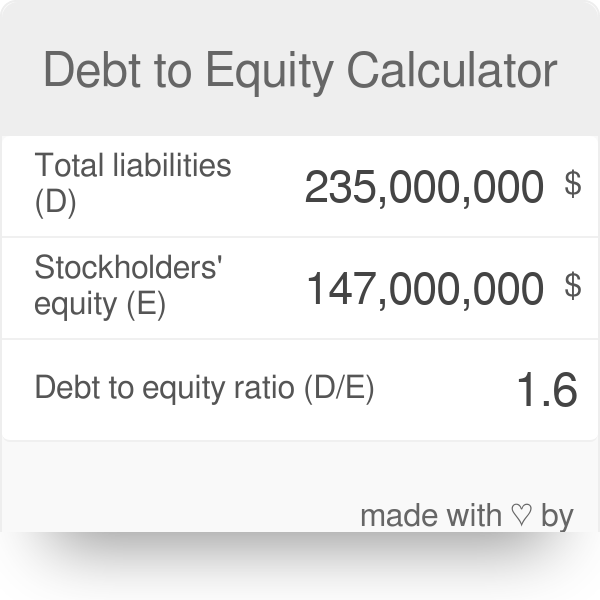

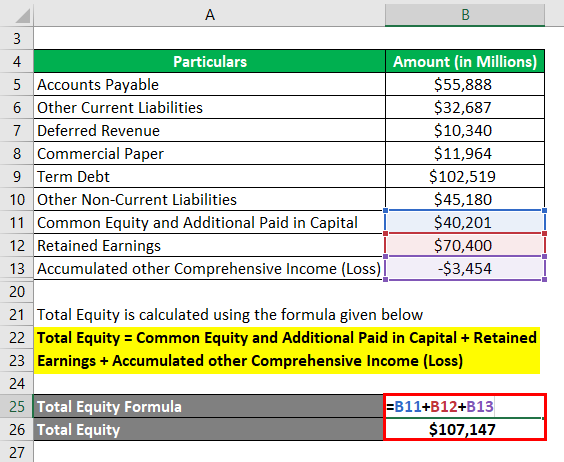

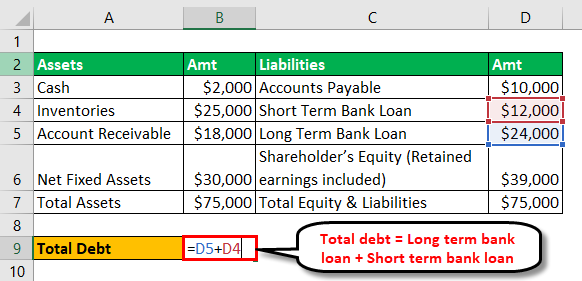

Debt To Equity Ratio D E Formula And Calculator Excel Template

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Debt To Equity Ratio Calculator

Leverage Ratios Formula Step By Step Calculation With Examples

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

How To Calculate The Debt Service Coverage Ratio Dscr Propertymetrics

Debt To Asset Ratio Calculator

Debt To Equity Ratio D E Formula And Calculator Excel Template

J62u1iuzxz5cfm

Debt To Equity Ratio Definition Formula Example

How Do You Calculate The Debt To Equity Ratio

How Do You Calculate The Debt To Equity Ratio

Leverage Ratios Formula Step By Step Calculation With Examples

How Do You Calculate The Debt To Equity Ratio

:max_bytes(150000):strip_icc()/debtequityratio.asp_FINAL-0ac0c0d22215418a992fa7facd2354e6.png)

Debt To Equity D E Ratio Formula And How To Interpret It

Debt To Equity Ratio Formula Calculator Examples With Excel Template